OVER 80% of small businesses struggle with cash flow!

Can I ask you a few questions about your business only to better serve you?

As businesses across the country grapple with economic uncertainty, many are looking for ways to reduce their costs and remain competitive. One option that companies can take advantage of is employee retention tax credits, which are available to businesses that kept their workers on the payroll despite financial hardship.We are here to help businesses reduce their taxes through employee retention credits. Our team of experts can provide you with the knowledge and resources you need to take advantage of these valuable credits and maximize your savings.

Claim Your ERC Recovery, LLC has been featured in large-scale media outlets.

But what if we told you that there’s a solution that can provide a much-needed boost to your cash flow and help you keep your top level employees? The answer lies in employee retention tax credits, but the real question is, are you ready to take advantage of this opportunity before it slips away?”

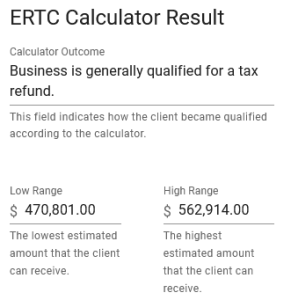

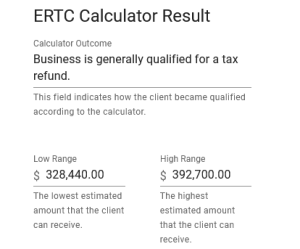

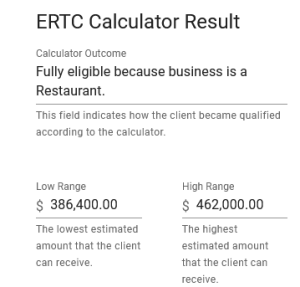

Here are just a few examples of companies that took action!